State of Rates

November 10, 2023

Latest Market Commentary.

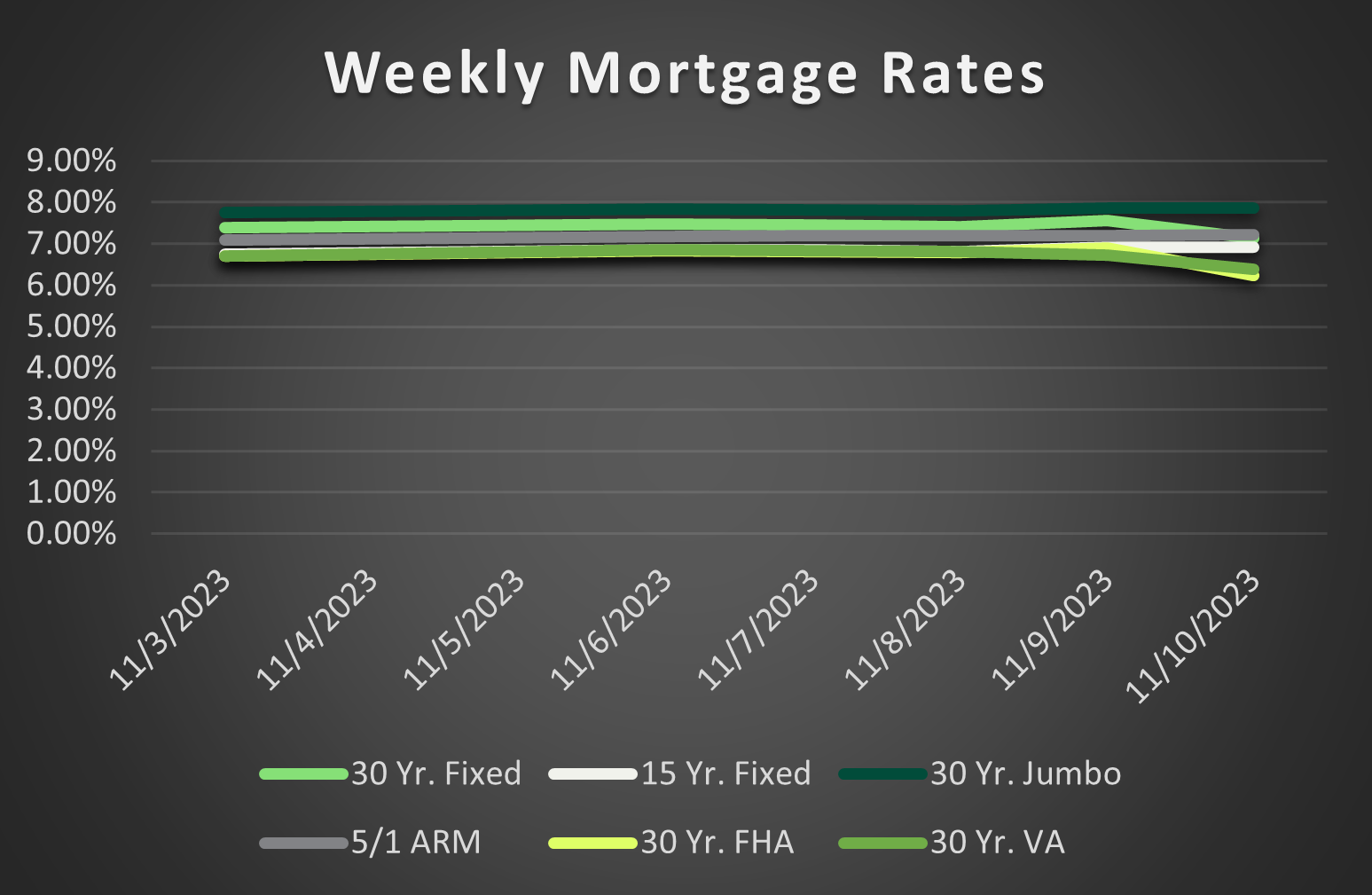

With minimal major economic reports this week, interest rates were influenced by the free market and comments from a few Fed Speakers. Last week was exceptional for interest rates, but it's typical for rates to stabilize or rise afterward.

The week remained relatively stable until Thursday when a disappointing 30-year treasury auction wiped out this week's gains and some of last week's. Additional remarks from Jerome Powell didn't help much, but rates still closed the week near 60-day lows and below the 50-day moving average.

All eyes are now on Tuesday's highly anticipated October Consumer Price Index (CPI) report. Even a slight month-over-month drop will confirm and contribute to the recent rally in mortgage rates.

Get ready for an eventful week ahead – it's bound to be a rollercoaster ride!

Should I Lock or Float?

While we are still biased towards locking at application, there are some great opportunities to float your rate in search of better rates. If you’re closing is 30 days or more out and you don’t mind gambling some you may consider watching how the market plays out over the next few weeks.